Decentralized finance (DeFi) has revolutionized the way we interact with financial services, offering greater control and flexibility to users. With the rise of DeFi platforms and decentralized applications (dApps), it’s crucial for investors to secure their digital assets effectively.

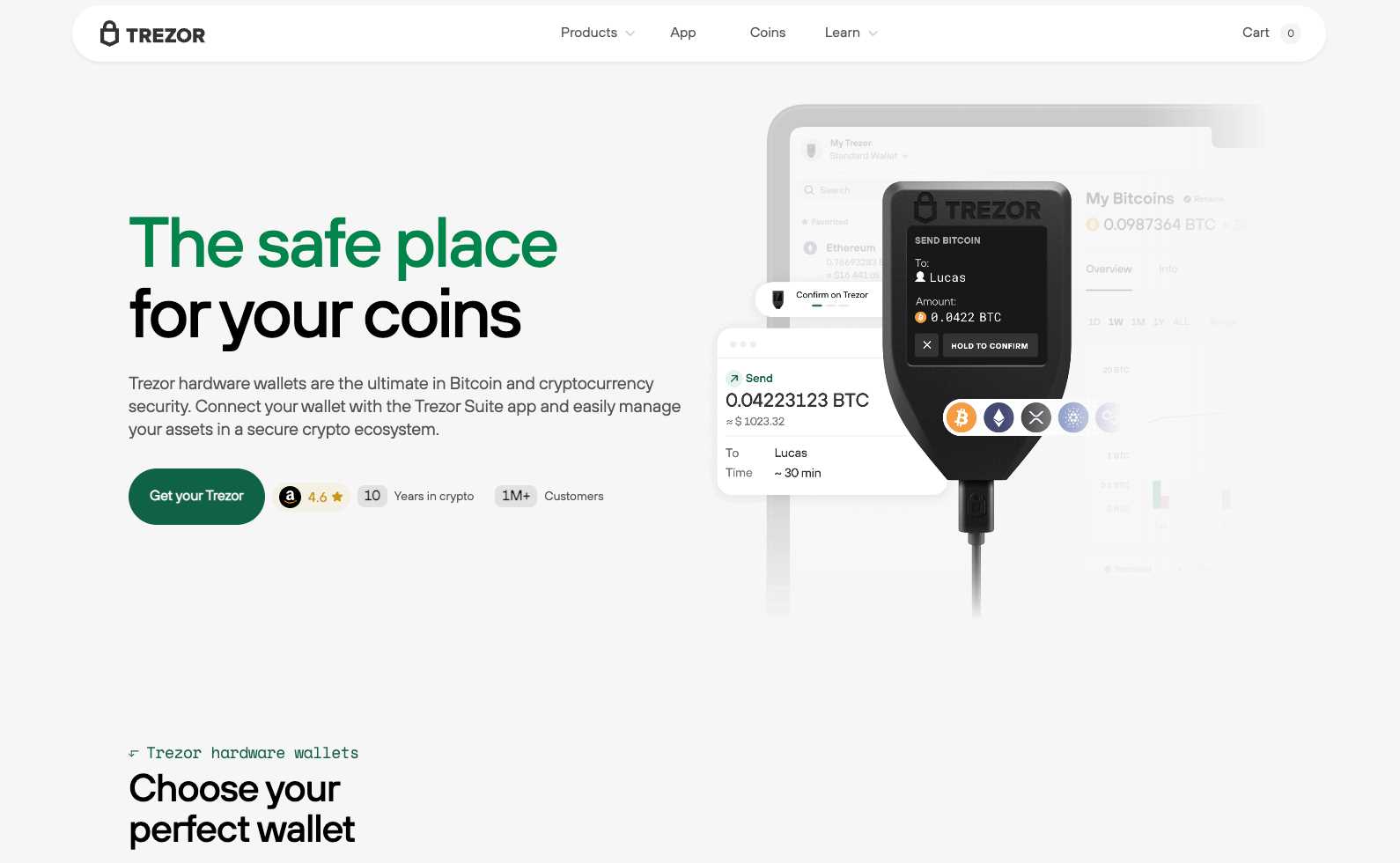

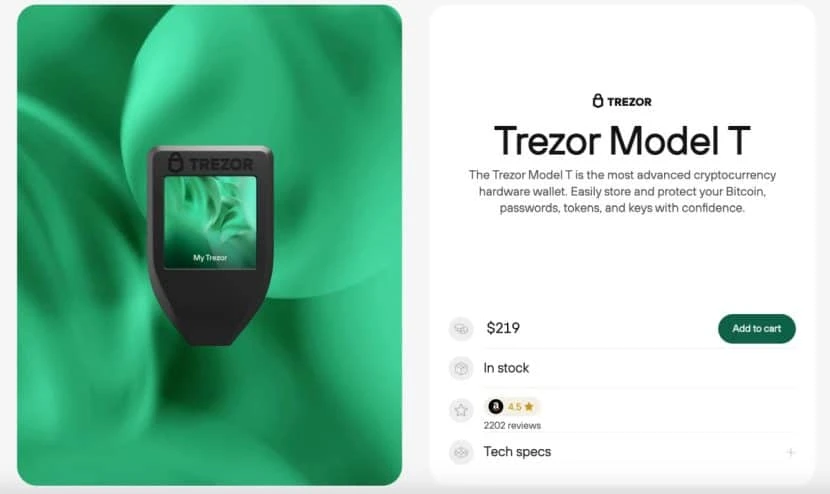

Trezor, a leading hardware wallet provider, offers a secure solution for managing and storing DeFi portfolios. By combining the convenience of a hardware wallet with the security features required for DeFi assets, Trezor is a popular choice among cryptocurrency enthusiasts.

This article explores the advantages of using Trezor to protect your DeFi portfolio, highlighting key features and best practices for secure asset management in the ever-expanding DeFi ecosystem.

Maximize Your DeFi Portfolio With Trezor

DeFi (Decentralized Finance) has revolutionized the way we think about managing our finances, offering a range of opportunities to earn, lend, borrow, and trade without relying on traditional financial institutions. However, with this increased freedom comes added responsibility to secure your assets.

A Trezor hardware wallet is an essential tool for safeguarding your DeFi portfolio. By storing your private keys offline in a secure device, you can protect your assets from online threats such as hacks and phishing attacks. Trezor supports a wide range of DeFi tokens, allowing you to securely manage your portfolio directly from the device.

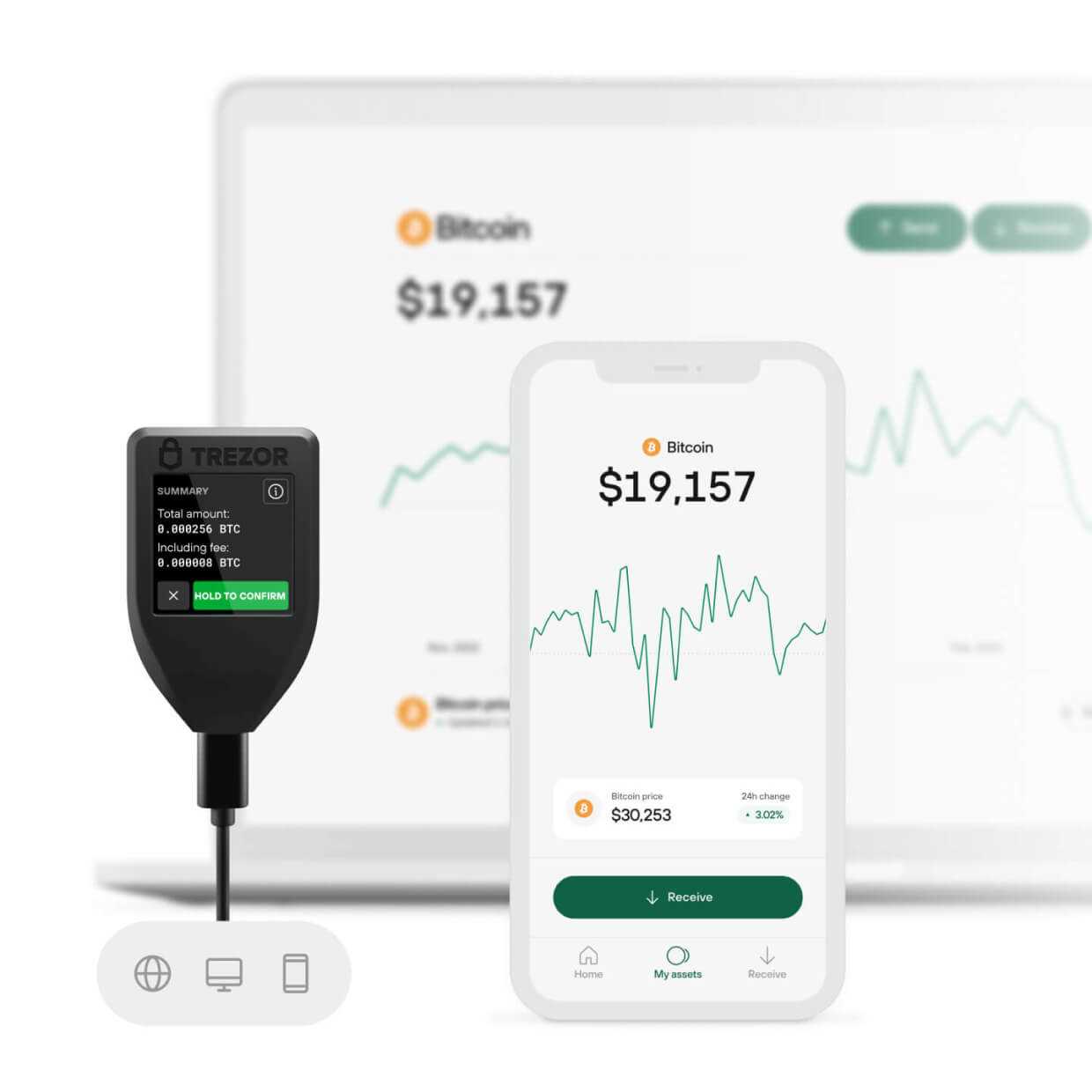

With Trezor, you can easily access popular DeFi platforms like Uniswap, Compound, and Aave, and participate in yield farming, liquidity provision, and more, all while keeping your assets safe. The user-friendly interface of Trezor makes it simple to interact with the DeFi ecosystem, empowering you to maximize your returns while minimizing risk.

Don’t leave your DeFi portfolio vulnerable to security breaches. Invest in a Trezor hardware wallet today and take control of your financial future with peace of mind.

Secure and Convenient Storage

When it comes to managing your DeFi portfolio, security is of paramount importance. Utilizing a hardware wallet like Trezor offers a secure and convenient storage solution for your assets.

With Trezor, your private keys are stored offline, away from potential cyber threats. This minimizes the risk of unauthorized access and ensures that your assets remain safe and secure.

Benefits of using Trezor for DeFi Portfolio Storage:

- Securely store multiple cryptocurrencies in one device

- Convenient access to your assets through a user-friendly interface

- Protection against phishing attacks and hacking attempts

- Backup and recovery options for added peace of mind

Diversify Your Investments

Diversification is an essential strategy when it comes to managing your DeFi portfolio on your Trezor wallet. By spreading your investments across different assets, you can reduce risk and potentially increase your returns.

When diversifying your investments, consider allocating your funds in a mix of stablecoins, cryptocurrencies, and DeFi tokens. This approach can help you hedge against market volatility and protect your portfolio from significant losses.

- Allocate a portion of your portfolio to established cryptocurrencies like Bitcoin and Ethereum for stability.

- Invest in DeFi tokens that have a promising future and solid fundamentals to capitalize on the growth potential of the decentralized finance space.

- Include stablecoins in your portfolio to preserve capital during market downturns and provide stability to your overall investment strategy.

By diversifying your investments, you can adapt to changing market conditions and optimize your DeFi portfolio on your Trezor wallet for long-term success.

Earn Passive Income

One of the key benefits of managing a DeFi portfolio with a Trezor device is the ability to earn passive income. By participating in decentralized finance protocols such as staking, lending, or providing liquidity, users can generate a steady stream of income without actively trading or investing.

Staking allows users to lock up their cryptocurrency holdings in order to support the network and earn rewards in return. This process helps secure the blockchain and ensures the integrity of the network.

Lending enables users to earn interest by loaning out their crypto assets to borrowers. This can be a lucrative way to generate passive income by utilizing the idle funds in your portfolio.

Providing liquidity involves supplying assets to decentralized exchanges or liquidity pools and earning a share of the trading fees. This strategy can also generate passive income while contributing to the efficient functioning of the DeFi ecosystem.

By strategically allocating your assets and engaging in these DeFi activities through your Trezor device, you can leverage the power of blockchain technology to earn passive income and grow your wealth over time.

Manage Your Assets Effectively

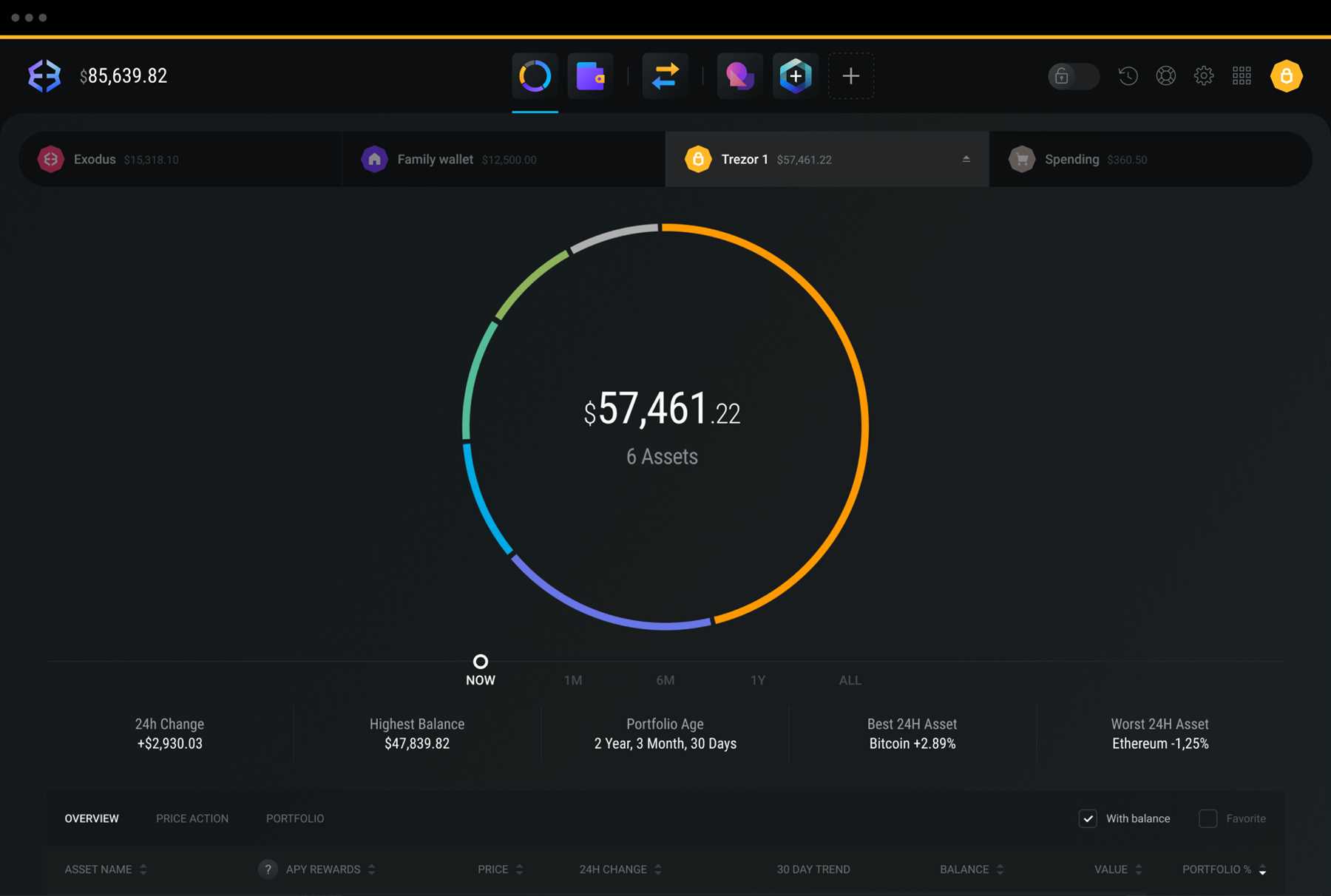

When it comes to managing your DeFi portfolio on Trezor, it’s important to stay organized and keep track of your assets effectively. Here are some tips to help you manage your assets efficiently:

- Regularly review your portfolio: Keep an eye on the performance of your assets and make adjustments as needed.

- Diversify your investments: Spread your investments across different assets to reduce risk and increase potential returns.

- Set investment goals: Define your long-term and short-term investment goals to help guide your decision-making process.

- Stay informed: Stay up-to-date with the latest news and trends in the DeFi space to make informed investment decisions.

- Use risk management tools: Utilize features like stop-loss orders and trailing stops to protect your investments from sudden price drops.

- Keep your private keys secure: Ensure that your private keys are safely stored on your Trezor device to protect your assets from theft.

By following these tips and staying proactive in managing your DeFi portfolio on Trezor, you can optimize your asset management strategy and achieve your investment goals.

Stay In Control of Your Funds

When it comes to managing your DeFi portfolio, keeping your funds safe and secure should be a top priority. With a Trezor hardware wallet, you can have peace of mind knowing that your private keys are stored offline and protected from online threats.

By using a hardware wallet like Trezor, you retain full control over your funds. You can securely store your assets, send and receive transactions, and manage your DeFi investments without relying on third parties or centralized exchanges.

With Trezor, you can easily access your DeFi portfolio through a user-friendly interface and keep track of your assets in one convenient location. Whether you’re new to DeFi or an experienced investor, having a reliable hardware wallet like Trezor is essential for staying in control of your funds and safeguarding your assets.

Access DeFi Opportunities

With a DeFi portfolio on your Trezor hardware wallet, you can access a wide range of decentralized finance opportunities. DeFi offers various ways to earn passive income, trade assets, and participate in innovative financial products without relying on traditional financial institutions.

Key Benefits of DeFi

- High-yield savings accounts

- Lending and borrowing platforms

- Decentralized exchanges for trading

By using your Trezor to securely manage your DeFi assets, you can take advantage of these opportunities while maintaining full control over your funds. Trezor’s cutting-edge security features ensure that your digital assets are safe from hacks and unauthorized access.

Protect Your Investments

When it comes to your DeFi portfolio on your Trezor device, security is of utmost importance. Safeguarding your investments from potential threats is crucial in the decentralized finance space.

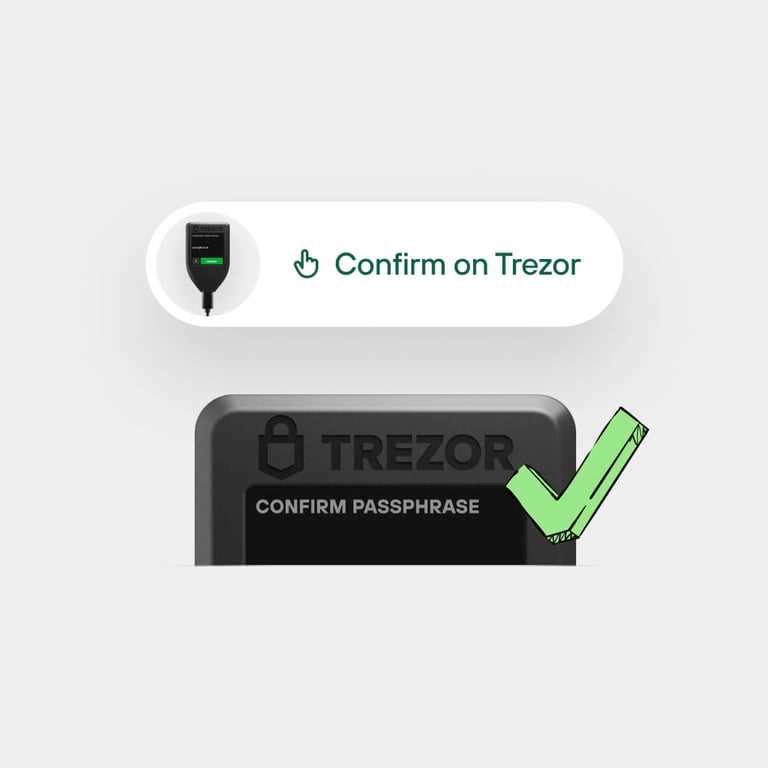

Ensure that your Trezor hardware wallet is always kept secure and never share your private keys with anyone. Regularly update your firmware to the latest version to benefit from the latest security features and enhancements.

Enable Two-Factor Authentication

Implementing two-factor authentication adds an extra layer of security to your DeFi portfolio. By requiring an additional verification step, you can prevent unauthorized access to your funds.

Stay Informed

Stay informed about the latest security practices in the DeFi space and be cautious of potential phishing attempts. By staying vigilant and proactive, you can protect your investments and enjoy peace of mind.

Ensure Peace of Mind

When managing your DeFi portfolio, security is of utmost importance. By utilizing a Trezor wallet, you can ensure peace of mind knowing that your assets are securely stored offline.

Secure Storage

Trezor offers secure cold storage solutions for your digital assets, protecting them from online threats such as hacking and phishing attacks.

Peace of Mind

With your DeFi portfolio stored safely in a Trezor hardware wallet, you can enjoy peace of mind knowing that your investments are safeguarded against unauthorized access.

FAQ:,

What is a DeFi portfolio Trezor?

A DeFi portfolio Trezor is a hardware wallet designed specifically to store decentralized finance (DeFi) assets securely. It allows users to safely store their cryptocurrencies and interact with DeFi platforms without exposing their private keys to potential hacks.

How does a DeFi portfolio Trezor work?

A DeFi portfolio Trezor works by generating and storing private keys offline in a secure hardware device. Users can access their DeFi assets through the device and authorize transactions without compromising their security. This ensures that their funds are safe from online threats.

What are the advantages of using a DeFi portfolio Trezor?

One of the main advantages of using a DeFi portfolio Trezor is the enhanced security it provides. By storing private keys offline in a hardware device, users can protect their assets from online hacks and theft. Additionally, the device is easy to use and offers a user-friendly interface for managing DeFi assets.

Can a DeFi portfolio Trezor support multiple DeFi tokens?

Yes, a DeFi portfolio Trezor can support multiple DeFi tokens. Users can store a wide range of cryptocurrencies and interact with various DeFi platforms through the device. This allows for diversification of assets within the portfolio and easy access to different DeFi opportunities.

Is it worth investing in a DeFi portfolio Trezor for security?

Investing in a DeFi portfolio Trezor for security is definitely worth it, especially if you hold a significant amount of DeFi assets. The added layer of protection and peace of mind that the hardware wallet provides can help safeguard your investments and prevent potential loss due to hacks or unauthorized access.